Bitcoin and Ethereum are still going sideways in this correction, but todays lower knot is encouraging. The consolidation though still appears to have a bit additional to go in time.

Summary

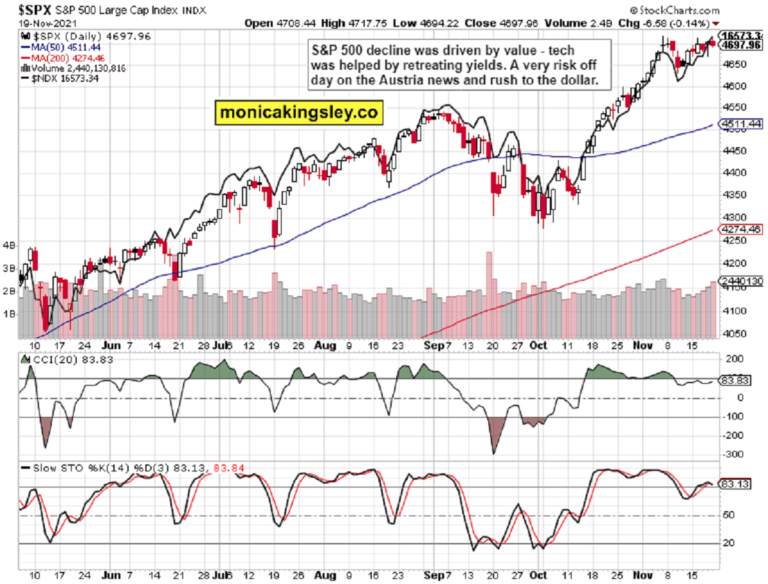

S&P 500 bulls keep hanging in there, and the waiting on bonds to come to their senses may take a while longer. Tech keeps cushioning the downside, and we have not peaked in spite of the numerous cautions. Value and Russell 2000 growths would be excellent verifications of the stock booming market getting fresh fuel. Rare-earth elements would have the easiest run in the weeks ahead– commodities in basic not a lot. Their breather is though of a short-term nature as all roadways cause genuine possessions.

Thank you for having read todays totally free analysis, which is available completely at my homesite. There, you can register for the totally free Monicas Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[e-mail protected] All essays, research and details represent analyses and viewpoints of Monica Kingsley that are based upon available and most current information. In spite of cautious research and best efforts, it might show wrong and be subject to change with or without notification. Monica Kingsley does not ensure the accuracy or thoroughness of the data or information reported. Her material serves academic purposes and need to not be relied upon as guidance or interpreted as supplying suggestions of any kind. Stocks, futures and choices are monetary instruments not ideal for every single investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her works, you concur that she will not be held liable or responsible for any choices you make. Investing, trading and speculating in monetary markets might involve high risk of loss. Monica Kingsley might have a short or long position in any securities, including those pointed out in her writings, and might make extra purchases and/or sales of those securities without notice.

Updated on Nov 22, 2021, 10:36 am

S&P 500 stumbled as worth plunged– corona fears are back as Austria lockdown might really well be followed soon by Germany. Overall, the reaction advises me of the corona market playbook of Feb-Mar 2020 when I aggresively took brief positions, riding them all the method down to the Mar 23 bottom. Q3 2021 hedge fund letters, conferences and more As of the end of September, Hawk Ridge had a gross Read MoreWe have a lot of incoming stimulus (both financial and financial), the economy is sluggish but the yield curve hasnt inverted the way it did in 2019– make no error, were in a rate raising cycle (even if the Fed didnt move, the markets would require it down the roadway). Worth and Russell 2000 growths would be good confirmations of the stock bull market getting fresh fuel. Investing, trading and hypothesizing in financial markets might include high threat of loss.

Copper smartly recuperated, moving at chances with the CRB Index, which I treat (specifically given Fridays Austria news consequences) as a vote of self-confidence that the economy isnt rolling over to a deflationarry hell (pun meant).

Bitcoin and Ethereum

Its as if the gold and silver bulls do not trust the most recent rally– I think thats a misconception for we have actually turned the corner, and rare-earth elements are about to shine– of course, invalidating the current miners weak point while doing so.

Petroleum

S&P 500 stumbled as worth plunged– corona worries are back as Austria lockdown might extremely well be followed soon by Germany. The mood on the continent is souring, and coupled with accelerating German inflation data, assisting to underpin the dollar. Overall, the reaction reminds me of the corona market playbook of Feb-Mar 2020 when I aggresively took short positions, riding them all the method down to the Mar 23 bottom. So, why am I not beating the bearish drum today also?

Q3 2021 hedge fund letters, conferences and moreHawk Ridge Presents Long Thesis For A French Fry MakerHawk Ridge returned -1.5% for the 3rd quarter, which was only somewhat much better than the S&P 400s -1.8% return. Q3 2021 hedge fund letters, conferences and more As of the end of September, Hawk Ridge had a gross Read MoreWe have a lot of inbound stimulus (both financial and financial), the economy is slow however the yield curve hasnt inverted the method it did in 2019– make no error, were in a rate raising cycle (even if the Fed didnt move, the markets would require it down the road). I understand, pretty absurd idea with 10-year yield at 1.54% and Oct YoY CPI at 6.2%– but the rates being even more unfavorable elsewhere, aid to discuss the dollar 2021 strength.

What gold and silver are smelling out, is that the Fed would have to reverse course once the tapering effects start biting some more– not now, with still more than $100bn regular monthly addition. Cyclicals and commodities that had actually enormously appreciated vs. year ago (oil doubled), are feeling the pinch of fresh economic activity curbs speculation in spite of the polar shift of U.S. strength in energy of 2019 and before. Begging the OPEC+ to increase production might refrain from doing the technique, and with a lot inflation already in (and still to come), the essential financial investment style is of real assets strength.

Valuable metals have broken out, are no longer an underdog, and the inflation information will not decrease for many months still. And even as they would, it would come at a palpable cost to the real economy, and the resolute fresh stimulus action wouldnt be then far off. As I composed in Apr 2020, its about the continuous stimulus thats the go-to action anytime the horizon darkens, for whatever reason. Wash, rinse, repeat.

Lets move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

Once corona go back to the spotlight, bets on “reversion to the mean” in credit markets are off. Deteriorating data get more focus, and flight to security is on, puncturing the trend of rising yields that would undoubtedly lead to yield curve control.

Gold, Silver and Miners

S&P 500 bulls still have the upper hand, and value recovery accompanied by great tech defence of high ground got, is the waited for mix. The marketplace breadth is narrowing, and needs to be reversed to provide the bulls more breathing space.

Credit Markets

Petroleum bulls didnt recuperate from Fridays spanner in the works, and while the dust hasnt settled, black gold is prone to an upside reversal at little notice. Im not overrating the oil index weakness.

Copper