The S&P 500 Read MoreFrom much-hyped tech initial public offerings (IPOs) to food and healthcare services, lots of companies with currently big followings have actually gone public this year. Some were supposed to go public in 2020 however got postponed due to the pandemic, and others saw the opportunity to take advantage of a strong current market.

This graphic procedures 68 companies that have actually gone public in 2021– consisting of IPOs, SPACs, and Direct Listings– as well as their subsequent evaluations after listing.

Whos Gone Public in 2021?

Historically, companies that wanted to go public employed one primary technique above others: the going public (IPO).

However business going public today readily pick from among 3 various choices, depending on market situations, associated costs, and shareholder preference:

Going Public (IPO): A personal business creates new shares which are underwritten by a financial organization and sold to the general public.

Unique Purpose Acquisition Company (SPAC): A different company with no operations is produced strictly to raise capital to acquire the business going public. SPACs are the fastest technique of going public, and have become popular in the last few years.

Direct Listing: A private business goes into a market with just existing, exceptional shares being traded and no brand-new shares created. The cost is lower than that of an IPO, since no costs need to be spent for underwriting.

The majority of business going public in 2021 chose the IPO path, but a few of the biggest assessments resulted from direct listings.

Listing Date

Company

Appraisal ($ B).

Listing Type.

08-Jan-21.

Clover Health Investments Corp (NASDAQ: CLOV).

$ 7.0.

SPAC.

13-Jan-21.

Affirm Holdings Inc (NASDAQ: AFRM).

$ 11.9.

IPO.

13-Jan-21.

Billtrust.

$ 1.3.

SPAC.

14-Jan-21.

Poshmark Inc (NASDAQ: POSH).

$ 3.0.

IPO.

15-Jan-21.

Playtika Holding Corp (NASDAQ: PLTK).

$ 11.0.

IPO.

21-Jan-21.

Hims & & Hers Health Inc (NYSE: HIMS).

$ 1.6.

SPAC.

28-Jan-21.

Qualtrics International Inc (NASDAQ: XM).

$ 15.0.

IPO.

09-Feb-21.

Metromile Inc (NASDAQ: MILE).

-.

SPAC.

11-Feb-21.

Bumble Inc (NASDAQ: BMBL).

$ 8.2.

IPO.

26-Feb-21.

ChargePoint Holdings Inc (NYSE: CHPT).

-.

SPAC.

There are lots of popular names in the list, one of the biggest through lines continues to be the importance of tech.

A bulk of 2021s freshly public companies have actually been in tech, including several mobile apps, websites, and online services. The 2 biggest IPOs up until now were South Koreas Coupang, an online market valued at $60 billion after going public, and Chinas ride-hailing app Didi Chuxing, the years largest post-IPO appraisal at $73 billion.

And there were many apps and services going public through other methods too. Video gaming company Roblox went public through a direct listing, earning a valuation of $30 billion, and cryptocurrency platform Coinbase has actually earned the years biggest evaluation up until now, with an $86 billion evaluation following its direct listing.

Big Companies Going Public in 2022.

Similar to every year, a few of the greatest business going public were lined up for the later half.

Tech will continue to be the talk of the marketplaces. Payment processing company Stripe was setting up to be the years biggest IPO with an approximated assessment of $95 billion, however got delayed. Online grocery delivery platform InstaCart, which saw a big growth in traction due to the pandemic, has been looking to go public at a valuation of at least $39 billion.

Naturally, its typical that prospective public listings and offerings fail. Whether they get delayed due to weak market conditions or cancelled at the last minute, anything can occur when it pertains to public markets.

This post has been upgraded since January 1, 2022.

Article by Visual Capitalist.

Updated on Jan 7, 2022, 3:11 pm.

In spite of its lots of troubled turns, in 2015 was a productive year for international markets, and business going public in 2021 benefited.

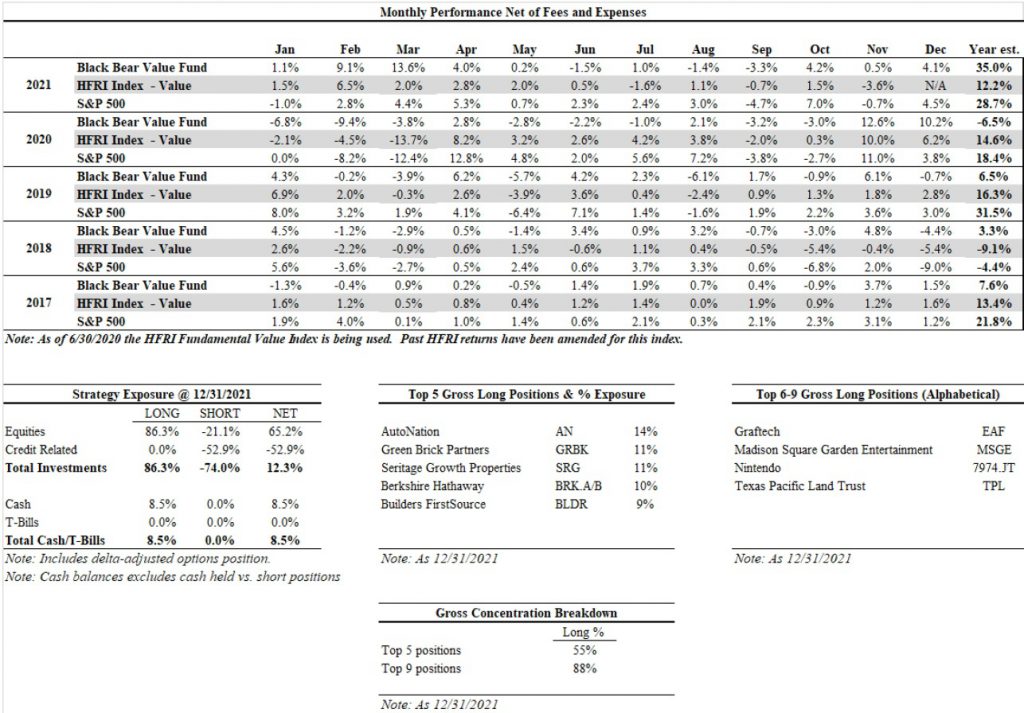

Q3 2021 hedge fund letters, conferences and more Black Bear Value Fund, LP (the “Fund”) returned +4.1%, web, in December and completed +35.0% in 2021. The S&P 500 Read MoreFrom much-hyped tech initial public offerings (IPOs) to food and healthcare services, many business with already big followings have gone public this year. Some were supposed to go public in 2020 but got postponed due to the pandemic, and others saw the chance to take benefit of a strong current market.

Payment processing company Stripe was setting up to be the years biggest IPO with an approximated evaluation of $95 billion, but got postponed. Online grocery shipment platform InstaCart, which saw a huge increase in traction due to the pandemic, has actually been looking to go public at a valuation of at least $39 billion.