After A Tough Year, Odey Asset Management Finishes 2021 On A HighFor much of the past decade, Crispin Odey has been waiting for inflation to rear its awful head. The fund manager has actually been placed to take benefit of rising rates in his flagship hedge fund, the Odey European Fund, and has actually been attempting to caution his financiers about the risks of inflation through his yearly Read MoreHistorically Negative Combination

Complicating things is a rise in inflation that is most likely to continue through these waves as years of easy cash policy, of lower labor share of wealth/income and now the global disruptions related to the virus will press rates up. That implies that we will need to manage through a period of lower development and greater inflation. Historically that is a really unfavorable combination for possession costs.

The peak of the very first wave appeared in the 3rd quarter financial declarations database update that was simply completed. The frequency of rising sales development and increasing gross revenue margins was lower in the period and it is those frequency numbers that usually mark the development peak.

Increasing Inflation And Interest Rates

The only method to defend our properties from the unfavorable affect of increasing inflation and rates of interest is to own speeding up companies. Only rising growth will offer defense versus increasing rates of interest. The rebound from the infection depressed levels in 2015 has most companies taping acceleration qualities.

Recently, the most significant rebound was the energy group where sales growth dropped to -50% (at the most virus depressed duration) however has actually because recovered to 44% in the current update; with a whopping 88% of energy companies accomplishing an enhancement.

Oil & & Gas Cycles

There are several cycles in our information record but in a normal oil and gas cycle we would start to see a velocity in capital investment as business react to greater oil costs with bigger expedition and development spending. Effectively carried out brand-new jobs would replace fading production somewhere else and add to provide growth.

Recent evidence recommends the opposite is taking place in the oil and gas market. Capital expenditures continue to fall relative to sales. Oil costs continue to advance, production is fading however not being replaced and supply development is slowing.

Energy Demand Continues To Grow

The world is not prepared to lower energy use. There is incredible resistance to higher oil costs and lower fuel-cost subsidies as we have seen in social discontent repeated in current years. Newest example in Kazakhstan.

Econ 101

From standard economic theory, we understand that the only method to minimize fossil fuel use is through higher costs. Greater energy costs and carbon taxes will sustain high inflation. The recent increase has lifted measured inflation by the fastest rate (7%) and to the greatest level considering that 1979 The present yield on long term bonds is 2% producing an after inflation (real) unfavorable return of -5%!

Back In 1979.

The last time (1979) inflation was acting in this pattern, long treasury bonds yielded 12% for a genuine return of 5%. The cost of long treasury bonds would fall by over 80% if Bond yields were to increase to 12% now. This is an approaching retirement disaster.

Extremely crucial to retired people, please evaluate your retirement accounts now and offer all fixed income securities. The only way to protect our possessions from the negative affect of rising inflation and interest rates is to own accelerating companies. Only rising growth will supply defense versus rising rates of interest. The rebound from the infection depressed levels in 2015 has most business taping acceleration attributes.

Otos MoneyTree

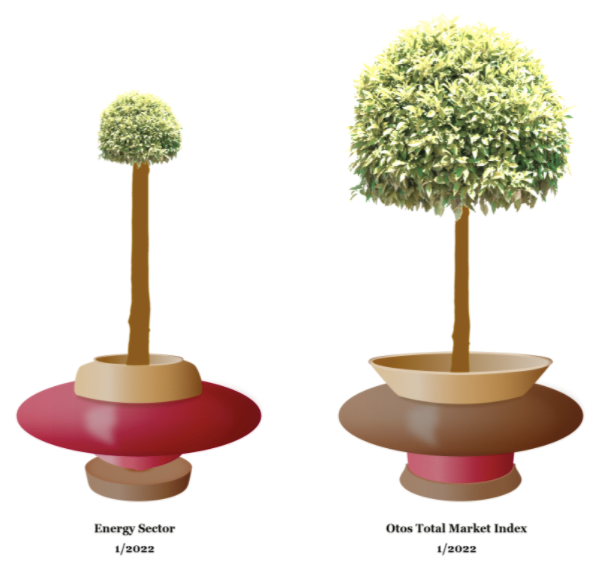

Otos displays increasing sales development and rising profit margins as a MoneyTree with a green globe, a dark trunk, and a golden pot. As business report their financial declarations in coming weeks, be meticulous around the development qualities of your portfolio business.

Whatever Quantitative Tools you pick to utilize, your portfolio of companies should have rising development qualities (MoneyTree with a green globe, dark trunk and hourglass shaped golden pot).

The present Otos Total Market Index portfolio MoneyTree below has high and rising sales growth, increasing profit margins and high operating/financial take advantage of.

Select Active Portfolio Management and verify that your portfolio attributes are, basically, growing!

SEC Filings Of Annual Reports

This is the last upgrade of the 3rd quarter monetary statement upgrade with the Securities and Exchange Commission (SEC) but soon updates from the 4th quarter year-end period will start. The majority of companies will quickly to be reporting their annual period ended December. The reporting due date for annual financial statements is later so it will be early March before we see a complete macro image (stay tuned).

All the very best in 2022 and take care!

Pleased New Year investors and pals! What an amazing brand-new year it is likely to be. Like a bolder dropped in a pond, the infection produced a substantial implosion of business growth in 2020 and an unmatched explosion of growth in 2021. Extending the ripple-in-a-pond metaphor we may expect that these waves will lessen in magnitude and after that settle. But when and how bumpy will the waves be in 2022? And which sector( s) will perhaps be causing it.

Upgraded on Jan 17, 2022, 3:53 pm

Like a bolder dropped in a pond, the virus produced a big implosion of corporate development in 2020 and an extraordinary surge of growth in 2021. That implies that we will need to handle through a duration of lower development and higher inflation. Just increasing growth will offer defense versus increasing interest rates. Oil costs continue to advance, production is fading however not being changed and supply growth is slowing.

Only increasing development will offer defense versus increasing interest rates.