Gold downswing left a lot to be wanted– we arent most likely staring at a real slide next. I really search for silver (and the cyclically sensitive commodities such as copper, and also oil) to surpass gold in the wake of the Fed move.

Petroleum

Copper actually doesnt want to decrease, and stays slated to play catch up to the CRB Index again. The enhancing bullish outlook needs simply time now– offering volume is drying up, tellingly …

Bitcoin and Ethereum

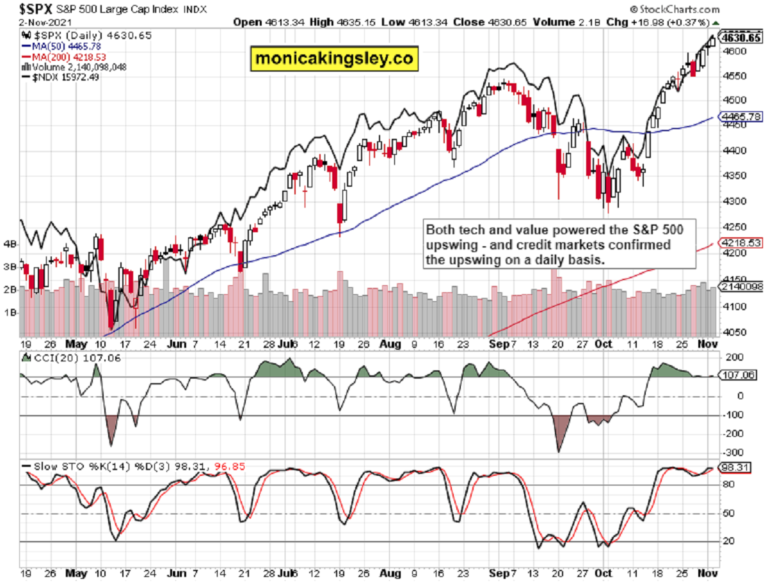

Universal risk-on relocation in the credit market, on volume that didnt dissatisfy, which simply confirms the bulls general technical benefit.

Gold, Silver and Miners

Even if just on a daily basis, thats where the bias is– long stocks still, but with a cautious eye as Treasuries and corporate bonds need to kick in on a more than everyday basis. Im taking it as that the bullish expectations for today are truly high– so much so that much better than expected non-farm work modification resulted in a sell the news response.

[soros] Q3 2021 hedge fund letters, conferences and moreGrizzlyRock Won Big With Its Shorts In Q3GrizzlyRock Value Partners returned 5.12% net for the third quarter, bringing its year-to-date return to 34.87%. The S&P 500 returned just 0.23%, while the Russell 2000 was up 4.6%. GrizzlyRock remained in the green on both the long and short sides. In fact, the funds short book outshined its long book, returning 4.98% gross, compared Read MoreDovish undertones are undoubtedly anticipated– a minimum of in trying to sweep the hot inflation under the carpet, spinning it somehow else than with the tired transitory horse. Discredited one too. How would the taper message be delivered, and could it go as far as $15bn a month property purchase decrease while preventing rate walking mentions as much as possible? Even if $15bn is indeed the revealed figure, Im looking for the Fed to soften it before it can run its course, i.e. prior to 2H 2022 shows up– the economy isnt in such a great shape to take it, and the fresh spending expense (whatever the cost), needs reserve banks support too.

Lets recall my the other days words about how thats most likely to equate into market moves:

( …) Overall, stocks havent made much progress, and are vulnerable to a fast downswing effort, which most likely though would not come today as the VIX does not look to prefer it. Wednesday, that might be another matter completely. Still, there is no imminent change to the stock bull operate on the horizon– the focus remains on ongoing Fed accomodations.

Tomorrows Fed taper announcement wouldnt change a lot– so much can (and will) happen in the meantime, allowing them to backpedal on the forecasts, making rate hikes much more of a pipeline dream. The Fed isnt taking inflation seriously, concealing behind the temporal sophistry, and thats one of the key motorists of rates marching up, increasing products, and surging cryptos. Search for more oil and natgas gratitude while copper increases again too. Precious metals are still waiting for a catalyst (believe dollar weakening when even increasing rates wont provide much assistance, and inflation expectations trending up much faster than yields)– a paradigm shift in wider recognition of Fed obfuscation and monetary policy being behind the curve.

The Fed turning much more dovish than expected, would light the fireworks– theyre likely to pay lip service to inflation similarly to Jun, but it will not pack the very same punch. Inflation expectations havent peaked, and the yield curve is about to steepen once again as rates would mostly be moving greater.

Lets move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

Even if just on a day-to-day basis, thats where the bias is– long stocks still, but with a careful eye as Treasuries and corporate bonds need to kick in on a more than daily basis. Still, there is no impending change to the stock bull run on the horizon– the focus remains on ongoing Fed accomodations.

Tomorrows Fed taper statement wouldnt alter a lot– so much can (and will) occur in the meantime, permitting them to backpedal on the projections, making rate walkings even more of a pipeline dream. Prospective S&P 500 bear raid is approaching, and the more dovish the Fed would be, the shallower dip in stocks can be expected. Investing, trading and speculating in financial markets might include high threat of loss.

Bitcoin and Ethereum bulls havent yielded, and keep the general technical advantage. Need to rates dip below $58K in BTC without strong purchasing materializing, now that would make me wary. The Fed will not be hawkish., no.

Summary

Potential S&P 500 bear raid is approaching, and the more dovish the Fed would be, the shallower dip in stocks can be expected. Cryptos, oil, copper would respond best, with valuable metals figuring it out just later on– unless the Fed adversely surprises, in which case cryptos would be vulnerable to wilder swings (but not drawback reversal in earnest).

Thank you for having actually read todays complimentary analysis, which is offered in complete at my homesite. There, you can subscribe to the totally free Monicas Insider Club, which features real-time trade calls and intraday updates for all the 5 publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[e-mail safeguarded] All essays, research and details represent analyses and opinions of Monica Kingsley that are based upon offered and most current information. Regardless of cautious research and best efforts, it may prove wrong and go through alter with or without notification. Monica Kingsley does not ensure the precision or thoroughness of the data or details reported. Her content serves instructional functions and must not be trusted as advice or interpreted as supplying suggestions of any kind. Stocks, futures and choices are financial instruments not ideal for each investor. Please be advised that you invest at your own threat. Monica Kingsley is not a Registered Securities Advisor. By reading her works, you agree that she will not be held responsible or responsible for any decisions you make. Investing, trading and speculating in monetary markets may include high danger of loss. Monica Kingsley may have a long or brief position in any securities, including those mentioned in her writings, and might make extra purchases and/or sales of those securities without notification.

Upgraded on Nov 3, 2021, 10:18 am

S&P 500 keeps rising, and is setting itself up for a brief dissatisfaction. We arent though making a leading with capital t.

Credit Markets

Crude oil didnt move much on a closing basis, but the bulls need more time to retake the reins.

Copper