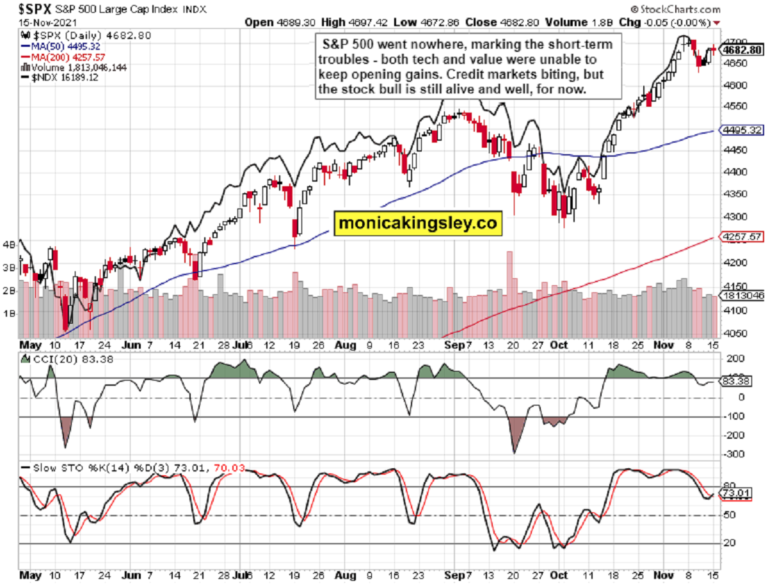

If VIX doesnt reveal that fully, S&P 500 is starting to run into an obstacle even. Credit markets going from weakness to weakness spells more short-term woes for stocks– a shallow downswing that feels (and is) a trading range prior to the rise to brand-new ATHs continues, is likely to materialize in the 2nd half of Nov. We might be in its opening phases– as composed the other day:

( …) Can stocks still continue rallying? They look to be setting up for one more downleg of the right away predecing magnitude, which suggests not a substantial obstacle. The medium-term course of least resistance remains up– the Fed is still printing a substantial amount of money on a regular monthly basis, and it remains questionable how far in tapering strategies execution they would in fact get– I see the dangers to the genuine economy paired with constantly high inflation as increasing considering that the 2Q 2022 (if not because Mar already, however most noticable in 2H 2022). Stocks are still set for a good Dec and beyond performance.Canyon Capital Is Riding The Wave Of Increased M&AC anyon Balanced Funds were up approximately 9.4% for the first 6 months of the year as all major possession classes in which they invest contributed positively to returns. In their August letter to investors, which was reviewed by ValueWalk, the Canyon team said distinctive catalysts involving a variety of balance sheet transformation events drove their Read MoreThe elephant in the room is (the absence of) fresh financial obligation issuance raising the dollar, making it like rising yields more. Not just that these are stopping working to push value greater, but the tech strength highlights the defensive nature of S&P 500 performance. Crucially though, rare-earth elements are seeing through the (misleading dollar strength) fog, and are sharply rising regardless. Make no error, with the taper response, we have actually seen what I had been anticipating (and even better considered that I prefer reasonably conservative stance without attracting expectations in any case)– I had actually been informing you that the hardest times for the metals are before taper.

And the magnitude and speed of their increase casts a verdict on the Feds (likely in) ability to follow through with the taper execution, let alone initiate the rate raising cycle without being chuckled off the phase as markets force these regardless of the main coordinators. The galloping inflation expectations are sending a really clear message:

( …) if you take a look at the fantastic white metals efficiency, its the outcome of inflation coming back to the fore as the Fed itself is now admitting to high inflation rates through the mid-2022, putting blame on supply chain traffic jams. Oh, sure. The real trouble is that inflation expectations are starting to get anchored– people are expecting these rates to be not disappearing whenever soon.

Rare-earth elements are going to do fantastic … Copper is awakening too, and products consisting of oil would be doing marvels. TLT downswings would be less and less conducive to growth, so if youre still heavily in tech, I would start eyeing more value.

Let me include the Russell 2000 and emerging markets to the well carrying out medium-term mix.

Lets move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

Petroleum bulls keep safeguarding the $80 level, with $78 acting as the next stop if need be– these consecutive lower knots keep favoring the bulls, simply when the right catalyst shows up. Whether that takes a couple of days or more, is irrelevant– it will take place.

Copper

S&P 500 is starting to run into a setback even if VIX does not expose that fully. Credit markets going from weak point to weak point spells more short-term problems for stocks– a shallow downswing that feels (and is) a trading variety prior to the rise to new ATHs continues, is most likely to emerge in the 2nd half of Nov. S&P 500 bulls are now holding only the medium-term upper hand as the rally is going into a debt consolidation stage. Anyhow, this trading range would be followed by fresh ATHs, which would power stocks even higher in early 2022. Investing, trading and speculating in financial markets might include high danger of loss.

Credit markets renewed their march lower, and unless they turn, the S&P 500 growths would stay on unstable ground (if and when they materialize).

Gold, Silver and Miners

Gold and silver stay on a tear, and even for the breather to unfold, it takes rather an effort. The bears plainly cant hope for a trend change.

Crude Oil

Bitcoin and Ethereum are seeing an emerging fracture in the dam that does not connect too well to developments elsewhere. The bulls ought to action in, otherwise this yellow flag threats developing into a red one.

Summary

S&P 500 bulls are now holding just the medium-term advantage as the rally is entering a combination phase. Anyway, this trading variety would be followed by fresh ATHs, which would power stocks even higher in early 2022. Rare-earth elements have rather some reaching do, and the long post Aug 2020 combination is over. Copper, base metals, oil and agrifoods are likely to keep doing terrific as inflation expectations show that inflation genuinely hasnt been tamed in the least.

Thank you for having actually read todays complimentary analysis, which is available completely at my homesite. There, you can sign up for the complimentary Monicas Insider Club, which includes real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[e-mail safeguarded] All essays, research study and info represent analyses and viewpoints of Monica Kingsley that are based upon offered and latest data. Regardless of careful research and best shots, it may show wrong and go through alter with or without notice. Monica Kingsley does not ensure the accuracy or thoroughness of the data or details reported. Her material serves educational purposes and must not be trusted as advice or construed as supplying suggestions of any kind. Stocks, futures and choices are financial instruments not appropriate for each investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or accountable for any choices you make. Investing, trading and hypothesizing in financial markets might include high threat of loss. Monica Kingsley might have a long or brief position in any securities, consisting of those discussed in her works, and may make extra purchases and/or sales of those securities without notification.

Updated on Nov 16, 2021, 10:35 am

S&P 500 bulls didnt make it too far before facing another (mild, once again I state) problem– up until now, a sideways one.

Credit Markets

Copper faced an unanticipated obstacle, which however does not alter the outlook thanks to its reasonably low volume. Im still looking for much higher red metals rates.

Bitcoin and Ethereum