For weekend reading, while talking about bitcoin, Louis Navellier uses the following commentary:

The S&P 500 Read MoreSince I composed in the past that bitcoin was acting better than the Ark Innovation Fund, in spite of their strong connection, the cryptocurrency chose to prove me wrong and begin consolidating below its 200-day moving average. While there is room to utilize blockchain technology in order to make the monetary system more efficient, the concept that one would bid up a minimal number of tokens to the sky– indicating $69,000 or so in the case of bitcoin, thus minting brand-new millionaires– is absurd. The stock price of this software company does not reflect the prospects of its software company as much as the prospects of bitcoin. Management is providing debt on more than one occasion to purchase more bitcoin (see “MicroStrategy Completes $500 Million Offering of 6.125% Senior Secured Notes Due 2028 with Bitcoin Use of Proceeds” on their Website).

If bitcoin collapses, Microstrategy might be in for one heckuva money flow issue.

Microstrategy holds bitcoin. The stock rate of this software company does not reflect the potential customers of its software application organization as much as the prospects of bitcoin. Management is releasing financial obligation on more than one occasion to purchase more bitcoin (see “MicroStrategy Completes $500 Million Offering of 6.125% Senior Secured Notes Due 2028 with Bitcoin Use of Proceeds” on their Website).

It does not take a monetary degree to realize that if the rate of your collateral collapses, a business still needs to service its financial obligations. If bitcoin collapses, Microstrategy could be in for one heckuva money flow problem. Someone needs to do a debt analysis on MSTR and find out when those maturities are clustering.

In the meantime, prior to the genuine drama begins, there is a negative divergence in between MSTR stock and bitcoin. MSTR stopped making new highs as it purchased more bitcoin (issuing more financial obligation) and bitcoin made a fresh all-time high right around the introduction of the futures ETF.

Due to the fact that of the increased utilize on the balance sheet, I believe the stock will continue to act improperly. MSTR stock might well trade listed below $400 (from over $600 a week ago) if bitcoin falls to $28,000.

The first half of 2022 pledges to not be tiring for either bitcoin or MSTR stock.

Navellier & & Associates does not own Microstrategy (MSTR) in handled accounts..

Upgraded on Jan 7, 2022, 5:16 pm.

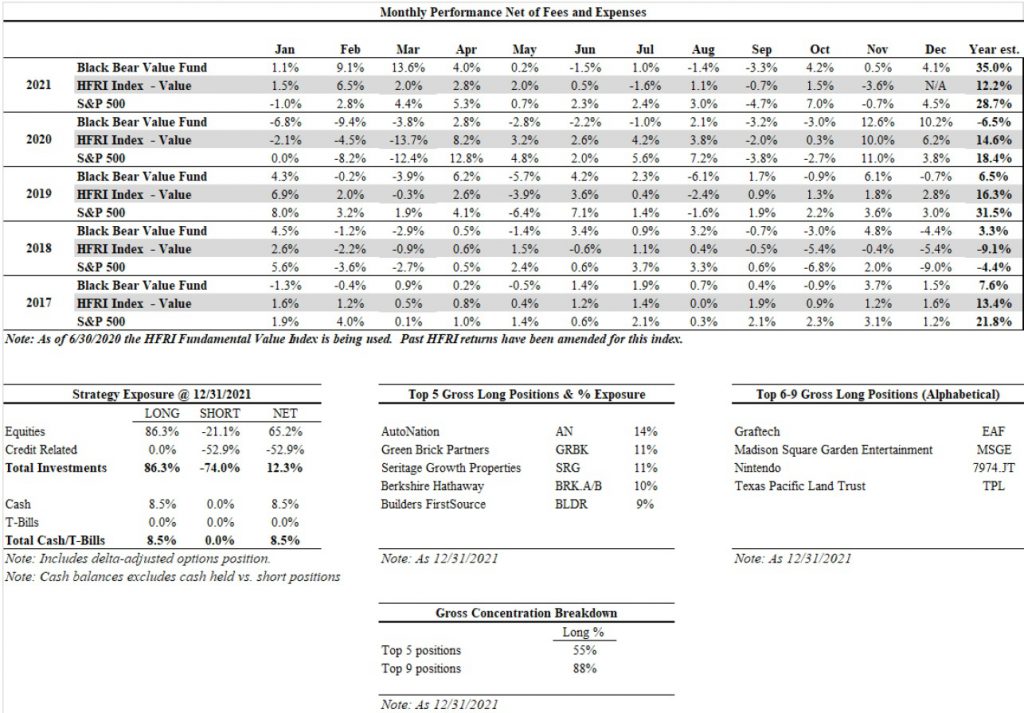

Black Bear Value Fund December 2021 Performance UpdateBlack Bear Value Funds performance update for the month ended December 31, 2021. Q3 2021 hedge fund letters, conferences and more Black Bear Value Fund, LP (the “Fund”) returned +4.1%, net, in December and completed +35.0% in 2021. The HFRI index has not released their December numbers however was +12.2% through November. The S&P 500 Read MoreSince I composed in the past that bitcoin was acting much better than the Ark Innovation Fund, despite their strong connection, the cryptocurrency chose to show me incorrect and start consolidating below its 200-day moving average. It has done that prior to and still handled to come back. The issue is that half the retail investors that hold bitcoin purchased it throughout the past year, and many of those are underwater.

If they bought it even if it was going up, they might offer it even if it is going down.

If this theory is valid, well discover out soon.

Breaking listed below $45,000 is a huge yellow flag, while decreasing listed below $40,000 would be an even bigger yellow flag. A move listed below $40,000 suggests a move all the method down to last summers low of $28,000. A break of last summertimes low would suggest a finished double top and a decline below $10,000.

I have heard the stories about how crypto will make the monetary system as we understand it unimportant. While no one is contesting the advantages of blockchain innovation, no government in their best mind would enable this to take place. That is one factor why China, India, and other countries banned bitcoin and crypto mining.

True, the Chinese are presenting a digital yuan, however this is to maintain and even increase the power of their central government over the financial system. The issue with the digital yuan is that at any given minute the Chinese federal government understands precisely how much cash you have and where it originated from, and it will also know where it is going at the accurate time you invest it. If there were ever an example of Big Brother, that is it. I am uncertain many U.S. residents would be keen on the Fed doing the very same thing.

While there is space to use blockchain innovation in order to make the financial system more efficient, the concept that a person would bid up a restricted variety of tokens to the sky– meaning $69,000 or so in the case of bitcoin, thereby minting brand-new millionaires– is absurd. This will likely end badly. The reality that it has not ended yet is an opportunity for those that speculated in bitcoin to go out prior to its far too late.

Microstrategy Has A Bitcoin Problem

” Bitcoin is a bank in cyberspace, run by incorruptible software application, providing an international, budget friendly, simple and safe and secure savings account to billions of people that do not have the alternative or desire to run their own hedge fund.”– Michael Saylor, CEO of MicroStrategy Incorporated (NASDAQ: MSTR).