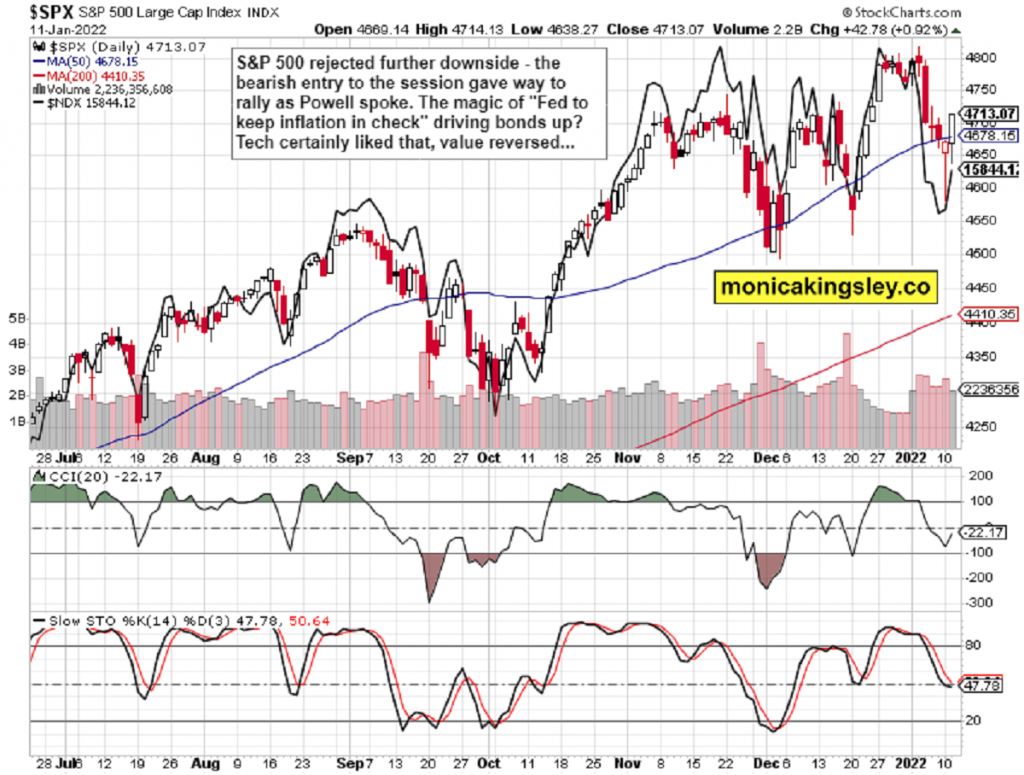

S&P 500 declined even more downside, tech ignited, and credit markets staged a risk-on turnaround. The bond upswing is the most crucial aspect– Powells testimony wasnt able to spark additional rise in yields at the moment.

Looking at todays rate action, the time of copper playing reach the other products has shown up already– the bears undoubtedly arent likely to take pleasure in much success over the coming months.

Bitcoin and Ethereum

Gold and silver position is enhancing, and I like it that miners keep coming alive. As composed yesterday, the stage is set for growth extension till we break out of the long consolidation.

Petroleum

HYG reversal looks reputable, even if the volume was lower. Its danger on as HYG outperformed– the next concern is how would it fare when yields increase again.

Gold, Silver and Miners

Petroleum is carrying out just right– breaking higher from the prior flag-like structure, and all at once being influenced by the oil stocks example– $80 resistance has actually been decisively secured.

Copper

The so-called “Tiger Cubs,” proteges of the famous Robertson, have become some of the crucial players in the hedge fund industry over the previous two years, with lots of Read MoreCouple that with continued energy surge, and were looking at real properties being very positively positioned here (reasonably most convenient gains ahead), and that has successful effects for oil, copper and valuable metals bulls. S&P 500 turnaround prospered, and markets are choosing to disregard the hawkish Fed and high inflation information. For now, the S&P 500 bears have actually been warded off, and it would take a fresh round of greater yields forcing tech down, to knock the 500-strong index lower, which isnt likely to take place today. In general, were looking at still a great year in stocks (examine the Latest Highlights for huge image choices), however 2H 2022 would be calmer than the prior 180 days.

Investing, trading and hypothesizing in financial markets might include high danger of loss.

Bitcoin and Ethereum are turning a corner, however animal spirits arent there now– are cryptos more knowledgeable about the coming liquidity challenges? The rebound is lacking eagerness still.

Summary

S&P 500 turnaround was successful, and markets are selecting to neglect the hawkish Fed and high inflation information. Thats all great for commodities and then rare-earth elements, however would catch up with stocks with time– in the sense that paper assets would underperform. For now, the S&P 500 bears have been fended off, and it would take a fresh round of higher yields forcing tech down, to knock the 500-strong index lower, which isnt most likely to take place today. In general, were taking a look at still a great year in stocks (inspect the Latest Highlights for big picture picks), however 2H 2022 would be calmer than the previous 180 days.

Thank you for having read todays free analysis, which is readily available in full at my homesite. There, you can subscribe to the totally free Monicas Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email secured] Futures, stocks and options are financial instruments not ideal for every financier. Investing, trading and speculating in financial markets may include high threat of loss. Monica Kingsley might have a long or short position in any securities, including those discussed in her writings, and may make extra purchases and/or sales of those securities without notice.

Updated on Jan 12, 2022, 11:23 am

Fresh effort at the lows was driven away, and the bulls arent looking too scared. Market breadth hasnt plunged to new lows, and is being slowly improved. It appears like were about to keep moving up prior to the bears return.

Credit Markets

Tiger Cubs Struggle In Volatile Year For Hedge FundsWhen Julian Robertson closed his hedge fund, Tiger Management, around 2 years back, he could not have forecasted how effective his so-called “Tiger Cub” managers would eventually end up being. The so-called “Tiger Cubs,” proteges of the legendary Robertson, have ended up being some of the crucial players in the hedge fund market over the previous 20 years, with lots of Read MoreCouple that with continued energy rise, and were looking at genuine properties being extremely favorably positioned here (reasonably most convenient gains ahead), which has lucrative consequences for oil, copper and precious metals bulls. Even cryptos like the fact that CPI didnt come above expectations.

Stock market fate is though connected to the Treasuries and business bonds– keeping an eye on the tech level of sensitivity to both advancing and retreating yields is of vital importance, with financials not sticking higher as a sore thumb amongst other S&P 500 sectors being the other.

Lets move right into the charts (all thanks to www.stockcharts.com).

S&P 500 and Nasdaq Outlook